Activity

Mon

Wed

Fri

Sun

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

Coffee Sometimes Tea Marketing

Private • 68 • Free

Being Real Mentorship

Private • 120 • Free

Credit connector

Public • 180 • Free

TS

Trucker School

Private • 32 • Free

Angelic Lift Wellness

Private • 36 • Free

Amazon For Beginners

Public • 942 • Free

BK

Brian K. Fleming

Private • 11 • Free

The Wealth Gap

Private • 28 • Free

2 contributions to Credit connector

American Express credit line increase rules

To maximize your credit limit on preset limit cards, follow the 3X CLI rule: 1. First month: Keep your balance between 10-30% of the maximum limit at any point during the billing cycle. 2. Second month: Increase your balance to 40-60% of the limit if desired. 3. Third month: Maintain a balance between 40-60% of the limit and ensure you meet any bonus requirements. 4. At the 91-day mark: Request a 3x increase on your current limit. Make sure your balance is $0 at the time of the request, and ensure all payments are fully posted, not just pending. 5. Once approved for the increase, mark a date on your calendar 181 days after this date to request the next CLI. 6. Months 4 to 9: Ideally, cycle the card once a month, but at minimum, do so every 3 months. 7. Your CLI will be 3x the newest limit. For example, if your limit is $2,000 on January 1st, you can request a CLI to $6,000 on April 1st, and then to $18,000 on September 29th. Please note that this strategy is specifically recommended for the Amex Blue Business Plus card. It is not necessary to follow this approach for personal cards, as Amex is not typically relied upon for high-limit preset cards. Regarding preset limits, it is advisable to not exceed a total exposure of $35,000 across all Amex preset limit credit cards, unless you are comfortable with potentially undergoing a financial review. For charge cards (such as Platinum, Gold, Green, Plum, and Black Card), there is no preset limit. The spending power on these cards automatically adjusts on a monthly basis, eliminating the need for CLI requests. I hope this clarifies the information for you. Let me know if you have any other questions!

12

10

New comment Jul 16

2 likes • Jul 14

This is great stuff, but I'm not clear on what you mean in step 6 when you say, "cycle the card once a month." Can you clarify? I'm eager to execute this with a BBP card that has been stuck at a $5300 limit FOREVER... Also, I have two companies that each have a BBP. When you say, limit exposure to $35,000 across all preset cards, would that mean that each company's exposure should be limited to $35,000, or that I should limit the total exposure for both companies together to $35,000?

Welcome

Let’s welcome Gabriel Garcia to our community. He’s a financial analyst that works for Merrill Lynch.

10

4

New comment Mar 11

1-2 of 2

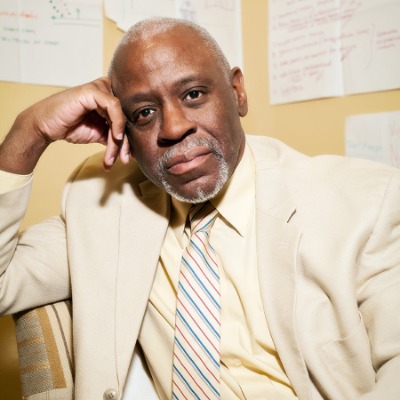

@elwin-green-9619

Wanna know a secret? C'mere...

Closer...I gotta whisper...

In my spare time, I conduct recorded performances of Mahler's "Resurrection" Symphony.

Active 5h ago

Joined Jan 8, 2024

powered by