Activity

Mon

Wed

Fri

Sun

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

LOVE NATION

Public • 19 • $25/m

6 contributions to LOVE NATION

"98" Trusts

Yes, you can get an EIN number that starts with "98" for ANY TYPE of foreign entity. Yet, its not the ONLY way to designate your foreign status. Its effective, yet its not THE ONLY way, nor is it the legally prescribed way to designate your foreign status. Technicslly speaking, in accordance with Federal Codes, the U.S.A puts Trusts through a court test, and a control test to determine its foreign or domestic status. Yet, the only 98 Trust that the IRS cares about are Trusts that are subject to the "1998 Foreign Trust Law". These are Trusts with at least 1 U.S. based owner... They pay taxes directly to the IRS. Yet, a "FOREIGN GRANTOR TRUST" is historically known to be a Trust in which the Grantor maintains ownership and is a foreign entity. Unlike a grantor trust, where the grantor is considered the owner of the trust property for tax purposes, a non-grantor trust is a separate legal and taxable entity. It has its own tax identification number (TIN) and files its own income tax return. So if they are recommending a "98 Grantor Trust" just know that is a non technical term to describe a "non-grantor" trust operating from a jurisdiction foreign to the U.S. that has been issued a tax ID nuber with a 98 prefix! Terminology means everything! "Overstand the Basics... Master the Matrix!"

3

5

New comment 1d ago

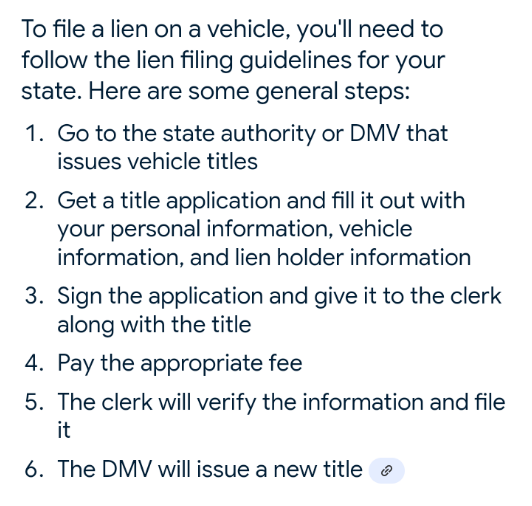

Transfer Vehicle to the Trust then...

Follow these steps to place a lien on the vehicle! Lienholder is The Trust!!!

3

3

New comment 1d ago

Commitments

Unity and Love Family. I hope all is well with everyone. On the Moonday be intentional with your energy. Tap into the divine feminine within you to enhance your intuition and discernment. Those are two very powerful spiritual gift to have while we navigate throughout our journey. Especially working on affairs. You can make better sound decisions when you thoroughly think before you put action behind what it is you want to bring into fruition.

5

0

Foundation

Unity and Love Family. I hope all is well with everyone. On the Saturn energy cycle (Saturday) make it intentional to ground yourself in your being and participate in things like meditation, breathing exercises, high frequency music or beats, and things that allow you to recenter yourself from this past full energy cycle (week). Every cycle is a new cycle to move in-tune with self.

2

0

A NU LIFE

Rise and shine family! Let’s take full advantage of the opportunity we have with another day at life to get a step closer to ultimate freedom! Remember you have dominion and authority over your life. That’s your God given right. Therefore, you’re meant to live how you see fit. WE ARE THE CREATORS, SO LETS CREATE!

4

2

New comment 5d ago

1-6 of 6

@joshua-seldon-7659

“Supercharge you imagination with affirmations to open the eye in your mind to infinite possibilities.” -Joshua Seldon©️

Active 3m ago

Joined Oct 31, 2024

powered by