Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Scott

The Outsourcing Blueprint is a community built for business leaders looking to reduce costs and scale effectively through outsourcing.

Memberships

Ignite Your Sales with Apollo

Private • 67 • Free

Skool Community

Public • 186.3k • Paid

Daily Stock Tip

Public • 5 • Free

Skool Launch (Free)

Private • 4.4k • Free

AI SEO Innovators Lab

Private • 91 • Free

The Skool Games

Private • 22.4k • Free

Paid Ad Secrets

Private • 2.3k • Free

4 contributions to Daily Stock Tip

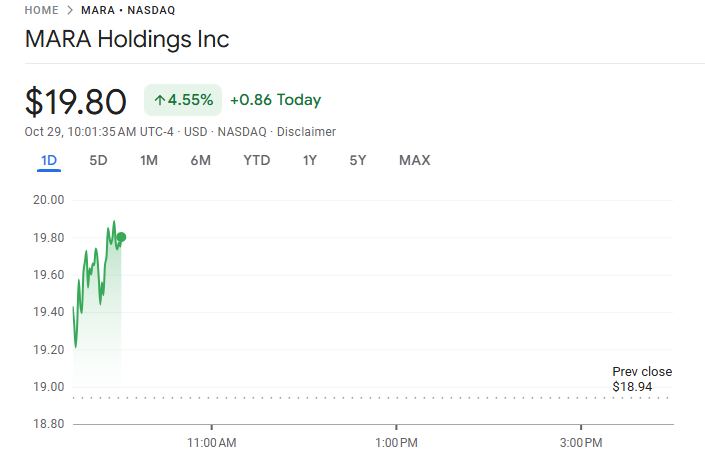

MARA • NASDAQ MARA Holdings Inc

This is not investment advice; it’s a trade idea for educational purposes. All trades are inherently risky and may result in a loss. Please do your own research. -------------------------------- MARA • NASDAQ MARA Holdings Inc Key Technical Indicators Currently trading at: $19.80 (above recent resistance) 20-Day Moving Average: $16.46, indicating short-term price trends. 50-Day Moving Average: $16.52, showing that the stock has been consolidating within this range recently Support Level: $17.45. Resistance Level: $18.99 Beta and Volatility MARA has a high Beta of 5.51, suggesting it is significantly more volatile compared to the overall market. This high volatility is typical for stocks within the cryptocurrency mining sector due to fluctuating crypto prices. Summary: MARA has experienced substantial price movements recently, and its average trading volume is around 40 million shares over the past 20 days, indicating strong market interest. The stock price currently trades close to its resistance level, suggesting potential breakout opportunities if it gains momentum. MARA Holdings, Inc. (formerly known as Marathon Digital Holdings, Inc.) operates as a digital asset technology company focusing primarily on mining digital assets, particularly Bitcoin. The company plays a significant role in securing the Bitcoin blockchain ledger, which involves validating transactions and adding them to the public ledger, ensuring the integrity and security of the cryptocurrency ecosystem. MARA leverages innovative technologies to convert underutilized, clean, and stranded energy sources into economic value through its digital asset compute operations. Essentially, they aim to use renewable or otherwise wasted energy to power their cryptocurrency mining activities, thereby supporting the broader push towards energy transformation. Founded in 2010 and headquartered in Fort Lauderdale, Florida, MARA Holdings has positioned itself as a leading player in the digital asset space, with a particular emphasis on increasing its operational hash rate to boost Bitcoin production. As of the latest data, the company has 109 employees and substantial digital asset holdings, making it one of the more prominent publicly listed Bitcoin miners.

1

1

New comment Oct 30

Digital Turbine Inc (NASDAQ: APPS)

This is not investment advice; it’s a trade idea for educational purposes. All trades are inherently risky and may result in a loss. Please do your own research. -------------------------------- Digital Turbine Inc (NASDAQ: APPS) A fast-growing player in the mobile advertising space, Digital Turbine has seen a surge in volume as investors respond to its impressive market penetration. Currently sitting at $3.31 per share, this stock is sitting right in the heart of the S/R channel (see attached chart). While slightly trending downward, it could break out either direction. Key Technical Indicators - 20-Day Moving Average: $3.27 - Resistance Level: $3.66 (5% above the highest recent close price) - Support Level: $2.87 (5% below the lowest recent close price) CAPM Analysis - Beta: 1.3 (higher volatility compared to the market) - Expected Return (CAPM): 9.5% As a longer term buy and hold, I think you can look for a decent return on this volatile stock. As a shorter term buy and sell, it is risky but has a potential upside. I bought this morning at $3.30 and plan to hold it short term to see how it moves. I will hold it longer term as needed, but I think this one has potential. See the attached Income Statement and Cash Flow Statement. There is a lot going on, but they have an influx of investment and financing cash and money to spend. Should be interesting to watch

1

1

New comment Oct 18

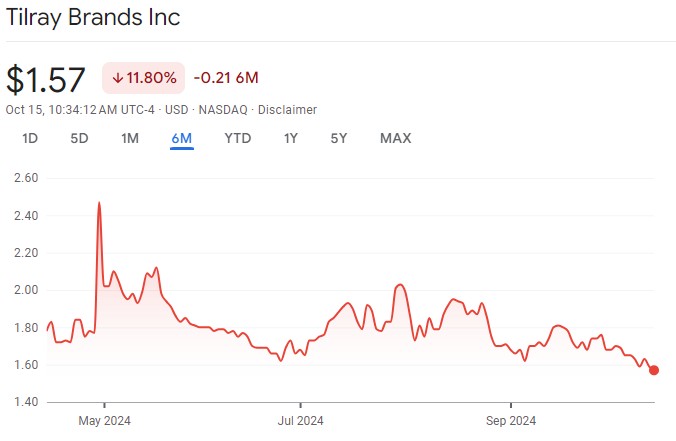

Tilray Brands Inc (NASDAQ: TLRY)

This is not investment advice; it’s a trade idea for educational purposes. All trades are inherently risky and may result in a loss. Please do your own research. -------------------------------- Tilray Brands Inc (NASDAQ: TLRY) From a Yahoo Finance post yesterday: "Tilray faces notable challenges following the ABI Acquisitions, completed on September 29, 2023. The company’s ability to harness expected revenue and sales growth is crucial, yet realizing operational efficiencies and cost synergies remains uncertain. Integrating the newly acquired craft beer operations demands significant resources and management focus, which could detract from other business areas. Moreover, any inability to effectively blend these operations into Tilray’s existing framework may lead to unforeseen liabilities, undermining the anticipated benefits and potentially impairing the company’s overall financial health." i see lots of upside for this stock where it sits right now at $1.56. Moving Averages - 50-Day Moving Average: $1.7562 - 200-Day Moving Average: $1.87825 Support and Resistance - Support appears near the recent low of $1.45. - Resistance might be around $1.63 (previous close) and $1.87825 (200-day moving average). I bought this today at $1.56 looking for a short-term gain which I will take, likely around $1.63, the resistance point. It is riding on the lower end of the support side of the S/R channel where it has been bouncing for the last six months, so a longer-term buy and hold could also pay off.

1

1

New comment Oct 16

Crown Electrokinetics Corp. (NASDAQ: CRKN)

This is not investment advice; it’s a trade idea for educational purposes. All trades are inherently risky and may result in a loss. Please do your own research. -------------------------------- Crown ElectroKinetics Corp (NASDAQ:CRKN) "has expanded its scope of services to include four complementary markets, enhancing its revenue potential. The company achieved a significant technical milestone by solving the 12-inch mastering challenge for its Gen 1 Alpha Smart Window Insert product." Despite technical progress, the Gen 1 Alpha Smart Window Inserts will only be available in limited quantities by the end of the year. The market this morning opened for CRKN having closed at $1.17, but then aftermarket trading had surged above $2.00, which caused a spike at the bell, and at one point it hit $1.85. Support: Likely near the recent 52-week low of $1.06. Resistance: Based on moving averages and historical data, possible resistance could be around the 50-day average of $1.62, with higher resistance at $9.47 based on the 200-day average. In the near term, I think that $1.62 is the saftest resistance bet, but if it powers upward above $2.00 and stays there during trading hours, that $9.47 looks interesting. I entered at $1.50 and exited at $1.65 very happy with the profit, mainly because I am not willing to wait to see if it rises sustainably through $1.62.

1

1

New comment Oct 10

1-4 of 4

@scott-smith-1762

I'm the founder of an outsourcing consultancy, a full-service solution building offshore partner teams with 28 years in offshoring and client support.

Active 6h ago

Joined Oct 7, 2024

INFP

Phoenix AZ, USA

powered by