Write something

Free Webinar - Introduction to Python for Data Analysis

Hi all!! I was thinking that it would be cool to start a series of webinars to teach the basics of Python. I would like to make it very interactive in order to answer all you questions and doubts. As you may know, Python is one the most used languages in the world and knowing it is a great advantage for interviews, university projects or simply at work. At least, it was in my case!! LIKE THE POST IF YOU ARE INTERESTED!

5

4

New comment May 22

Step 1 - Welcome to Baglini Finance!

💻 Please introduce yourself by commenting below and telling us your: 1. Name 2. Where you're from 3. Educational and/or Professional Background 4. Why you joined this community 5. Your LinkedIn profile (optional) ❓ Please reply to our introductory surveys under the "Pools" Category 📌 After introducing yourself, please read the other pinned posts that contain important information you should know. 🔗 If you want to connect with others and share your social media accounts (tastefully), please make these posts under the "Self promo" category. DO NOT PROMOTE YOUR PAID SERVICES (mentorship, other skools, courses, etc) YOU WILL BE BANNED 🔇 Many members will be commenting on this post so you may want to mute notifications after commenting. To mute your notifications after commenting, go to the top right corner of this post and click on 'Watching' to change it to 'Watch'.

4

8

New comment May 14

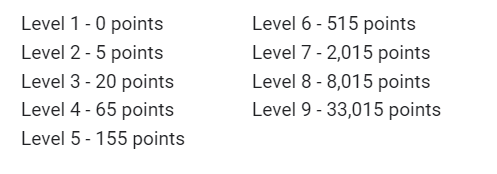

Important Communication - Give Away Investment Strategy - Level 3

I decided that I will give away one of my investment strategies to the first person who reaches Level 3. Also, I'll teach you exactly how it works and how to implement it yourself in a 1-to-1 call. Keep posting and interacting to make this community as engaging as possible!!

1

0

Interest rate planning cut by the Fed - What is the impact on the economy ?

Since December last year, the Fed has signaled it would expected to cut its key interest rate by the equivalent to three quarter-point cuts, from the current range of 5.25 to 5.5 per cent. Up until March, markets were betting that policymakers would make more cuts as inflation remained and growth slowed. What will be the impact of the interests rates cuts by the Fed on the economy ? - Increased Borrowing and Spending: Lower interest rates make borrowing cheaper for businesses and consumers. This often leads to increased borrowing for investments in business expansion, such as equipment purchases or infrastructure improvements, and for consumer spending on big-ticket items like homes and cars. This boost in spending can stimulate economic growth. - Stimulated Investment: Lower interest rates encourage businesses to invest more in projects that require borrowing. This can lead to increased capital spending, which can enhance productivity and innovation in the economy, ultimately driving long-term growth - Housing Market Activity: Lower interest rates tend to reduce mortgage rates, making homeownership more affordable. - Stock Market Response: Equity markets often respond positively to interest rate cuts, as lower rates can make stocks more attractive relative to fixed-income investments. This can lead to higher stock prices and increased investor confidence, which can further stimulate consumer spending and economic activity. - Weakened Currency: Lower interest rates can lead to a decrease in the value of the currency as well. - Impact on Savers: While borrowers benefit from lower interest rates, savers may see lower returns on their savings and investments, particularly in fixed-income assets like bonds and savings accounts. I would be happy to read some of your thoughts about the subject. Guillaume

2

2

New comment Apr 9

Disable Email Notification

If you are receiving too many email notifications, you can disable this feature by going to Profile Settings -> Notifications and change the group settings. Find more information at this link

0

0

1-7 of 7

skool.com/baglini-finance-6899

A community on Quantitative Finance, Investments, Portfolio Management and much more.

powered by