Write something

Today's Sales Success And Win

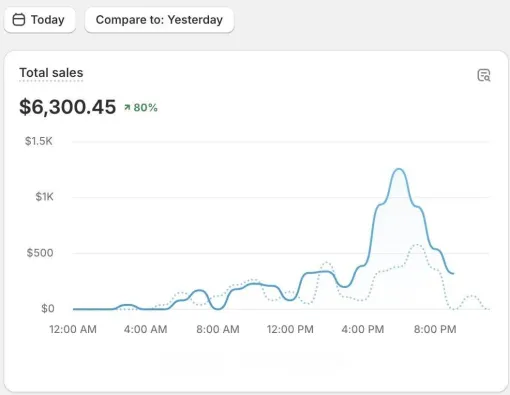

Today, I proudly hit the milestone of $6K in sales at my women’s fashion store, a testament to hard work and the incredible support from my customers! Thank you for believing in my vision! 🌟👗

0

0

SUCCESS AND WINS

Hi everyone! I am happy and excited to be part of this community, I've gained experience through selling on Etsy and eBay, ventured into crypto, and now I’m doing much better with Shopify dropshipping. It’s been a journey of learning and growth, and I’m excited to share insights and connect with others in this community. Looking forward to our discussions!

1

0

Mortgage Rate Update Sept 9th

With the Fed meeting just a week away on September 17th, they’ve already signaled an upcoming rate cut, leading to a steady decline in mortgage rates over the past two weeks. The market has already factored in the cut, as reflected in the current mortgage rates shown below. As rates continue to drop, do you think this will trigger a surge in new inventory, or will we see a wave of buyers eager to take advantage of lower borrowing costs? Conventional - 760+ Rate: 5.99% APR: 6.429% FHA/VA 660+ Rate: 5.25% APR: 6.527% FHA/VA 640 Rate: 5.625% APR : 6.527% (These rates are based on a 500k purchase price, first lien, 30YR fixed, owner occupied, single family home, 3-3.5% down)

0

0

Loan Estimate Review (How Mortgage Lenders Try To Be Sneaky)

🔍 **How Mortgage Lenders Try to Be Sneaky** When you’re under contract, your mortgage lender is required to send you a Loan Estimate sheet. But here’s where things can get tricky: 1. **Interest Rate Lock** 🔒 The first thing you need to check is whether the interest rate is locked. If it’s not locked, the lender can list any rate they want, often quoting a super low rate to hook you in. But beware, that rate can change when it’s time to lock it in! 2. **Payment Breakdown** 💵 The total payment amount you see on the estimate is directly tied to that interest rate. If the rate isn’t locked or isn’t accurate, your payment could change, potentially costing you more than expected. 3. **Estimated Cash to Close** 💰 This figure includes your closing costs and down payment. Make sure to double-check this number, as any discrepancies here can affect your overall budget. 💬 **Buying a House?** If you want me to review your Loan Estimate and ensure you’re getting the best deal possible - Message me the Word 'LOAN' and I'll help you out!

0

0

Investing in Real Estate Just Got Easier—No Income Verification Required!

Are you finding it tough to secure a loan because your tax returns don’t show enough income? Or maybe you’re struggling to gather the cash needed for your next investment property? You’re not alone—many investors face these challenges, especially when writing off a significant portion of their income. But don’t let that stop you from growing your real estate portfolio. I’ve got the perfect solution. This week alone, I’ve helped three investors close on their properties using this exclusive loan program, and you could be next. Here’s what you need: • A credit score of 680 or higher • 20% down payment • No income verification required—that’s right, no tax returns, paystubs, or W-2s needed! Here’s why it’s a game-changer: As long as the market rent for the property covers the mortgage payment, you’re approved! That’s the key requirement—no digging into your finances, just a straightforward path to owning your next investment property. Ready to take the next step? Message me today, and let’s get started. I’m licensed in 49 states and ready to help you secure your next real estate investment—no hurdles, just results.

0

0

1-6 of 6

skool.com/entrepreneur-home-buying-101-7228

I've helped 100s finance real estate and I specialize in home loans for entrepreneurs. I will find you the best rate with the lowest downpayment.

powered by