Activity

Mon

Wed

Fri

Sun

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Big Deal Maker

Private • 222 • Free

OPM Intensive

Private • 176 • Free

Apartment Investing Secrets

Public • 340 • Free

Capital Connectors

Public • 868 • Free

Real Estate Investing

Private • 3.3k • Free

REI Binder

Private • 258 • Free

RE Marketing Community

Public • 324 • Free

Multifamily Off-Market Club

Private • 578 • Free

Innovagents Realtor Mastermind

Public • 414 • Free

1 contribution to Apartment Investing Secrets

Sad Story for the Impatient But Exciting Times...

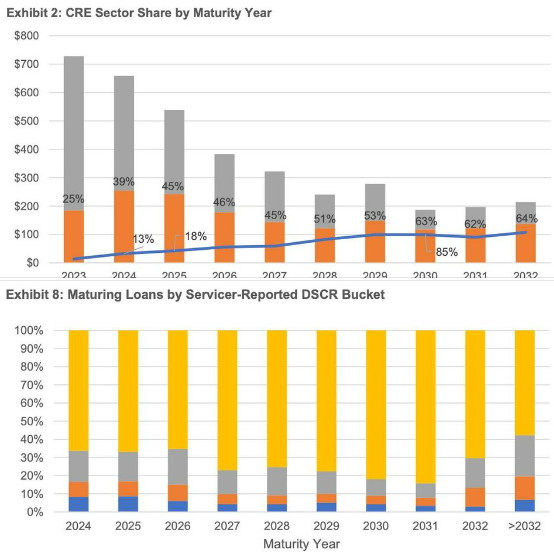

for those with patience. What am I talking about? From 2020 to 2022, newer apartment investors laughed at how I do my underwriting. Politely they told me I was being conservative. Some told me that the deals I was looking for were "unicorns". I look for apartment deals that have 2.5 to 3x+ equity multiple WITHOUT assuming rent increases of 3-5% per year. I've been investing since 1999 so I know that rents DO NOT always go up 3-5% per year. Most of these newbie apartment syndicators were buying apartment deals that I consider BORDERLINE or mediocre deals that become "OK deals" because of the low-interest rates during those 3 years. They were impatient to get a deal. But I did not give in and followed the crowd. I stuck with my "too conservative" underwriting and I patiently waited for deals. During those 3 years, I added $100M worth of deals to my portfolio so my patience was rewarded and I proved that those "unicorn" deals exist. And today, that patience will be rewarded even more. There are $500B worth of multifamily mortgages that are MATURING in 2024 and 2025. Out of those, about 8-9% have a DSCR of less than 1. DSCR stands for Debt Service Coverage Ratio. A DSCR of 1 means the property can't even pay for the mortgage payment. So those are definitely going to be foreclosed on. Another 8-9% have a DSCR between 1 to 1.25. With today's higher interest rates, the DSCR of those mortgages if they refinance today will also be 1 or even below 1. In other words, those will be candidates for foreclosure too. That's a total of $90B of multifamily mortgages that will be FORECLOSED on in the next 2 years. It's a sad story for those impatient apartment syndicators. But it's an exciting time for those who patiently waited and not given in to FOMO.

2

1

New comment Apr 18

0 likes • Apr 18

Awesome write-up. I always ensure we get fixed debt and that the property has plentiful income to cover future capex, reserves, vacancy, unit turnovers, inflation, insurance, etc. Shoring up a purchase even further by doing what you taught: buy the deal right and buy in the path of progress.

1-1 of 1

Active 22h ago

Joined May 25, 2023

Tampa, Fl

powered by